Public offering of Proacta S.A. series N shares.

This material is for promotional and informational purposes only and in no way constitutes a recommendation to purchase shares or a basis for deciding to acquire shares in Proacta S.A. The Offering Document, prepared in connection with the public offering of Proacta S.A. shares, is the only legally binding document containing information about the Company and the public offering of the Company’s shares in Poland.

Registration deadline

Deadline for registration under invitations issued by the Management Board

July 23 – August 6, 2024

Proacta S.A. is a public company listed on the ASO New Connect market operated by the Warsaw Stock Exchange.

Description of activities

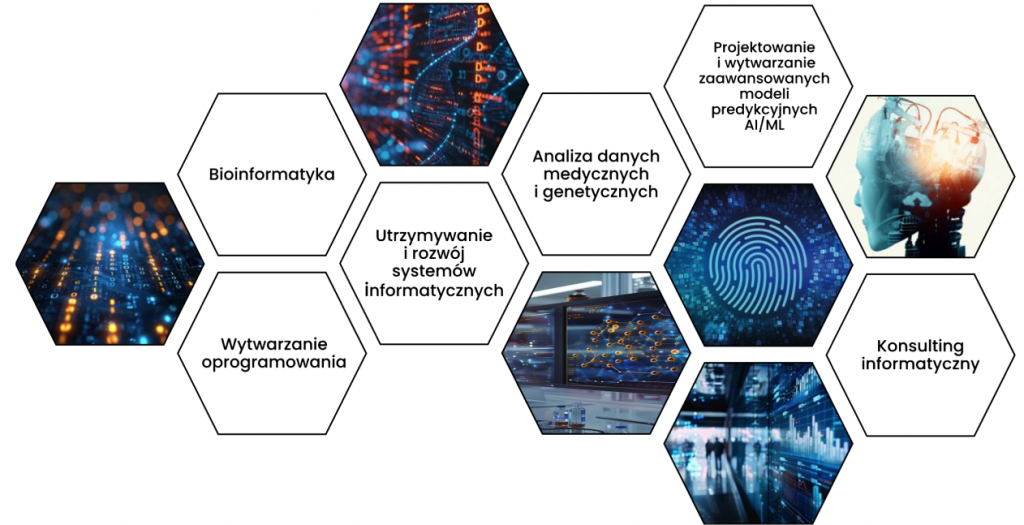

Proacta S.A. is the parent company of the Proacta Capital Group, operating in the field of bioinformatics and artificial intelligence-based medicine in Poland. The company provides technologically advanced services, focusing on the analysis of medical and genetic data, bioinformatics, and the design and creation of predictive models based on artificial intelligence.

In addition, as part of its diversification strategy, the Issuer provides programming services, creating dedicated software for business entities (i.e., in a B2B formula). Group structureThe Issuer forms a Capital Group consisting of two subsidiaries: Databion sp. z o.o. and VE Space sp. z o.o. Proacta S.A. holds 100% of the share capital and 100% of the votes at the General Meeting of the aforementioned subsidiaries. The subsidiaries are excluded from consolidation pursuant to Article 58 of the Accounting Act.

Group Structure

The Issuer forms a Capital Group comprising two subsidiaries: Databion sp. z o.o. and VE Space sp. z o.o. Proacta S.A. holds 100% of the share capital and 100% of the votes at the General Meeting of Shareholders of the aforementioned subsidiaries.

Subsidiaries are excluded from consolidation pursuant to Article 58 of the Accounting Act.

Market for business activities

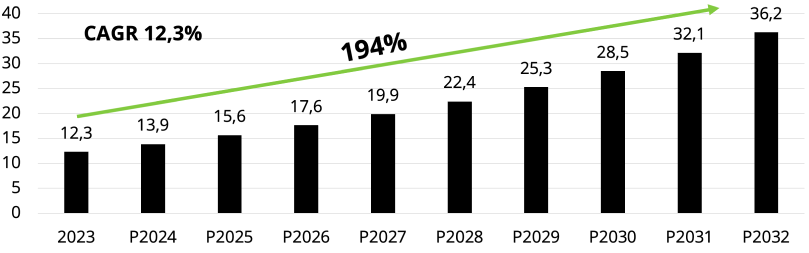

The bioinformatics market, driven by growing demand for integrated solutions in data processing, integration, and management, as well as the development of artificial intelligence (AI) and machine learning (ML) applications, plays a key role in areas such as healthcare, clinical diagnostics, and precision medicine.

This market reached a value of $12.3 million in 2023, and its estimated value by 2032 will be $36.2 billion with a CAGR of 12.3%, representing a 194% increase over 9 years (source: Imarc Services Private Limited).

Business segments

The Issuer’s main area of activity is the provision of services based on advanced technologies in the following areas

Despite the Issuer’s involvement in medical projects, the Company has been implementing IT projects for over 15 years (operating as Proacta Sp. z o.o. before 2023) as part of programming services and IT specialist outsourcing. The Group has completed over 100 projects for 60 business clients related to the design, production, development, and maintenance of IT systems for clients from the private and public sectors. As of March 31, 2024, the Issuer generated all of its sales revenue in the amount of PLN 1.6 million from the above-mentioned business segment.

Services for the medical sector

In 2018, the Issuer (then operating as Proacta Sp. z o.o.) began work on its proprietary Databion technology platform. It is a multifunctional analytical platform for the collection, processing, and analysis of medical and genetic data.

In connection with the continuous development of the platform, the Company has created a number of proprietary solutions based on the experience gained during its development and through the implementation of research and development projects. These are products dedicated to the medical sector and individual patients, which use advanced information technologies, including artificial intelligence (AI) and machine learning (ML).

I take care of myself Smart Lab

Digital Breast Cancer Unit

Patient Portal

The Issuer’s customers and key partnerships

The company has cooperated and implemented projects for many business entities from various industries, including:

Olimp Laboratories, PPUC Envelo, Simple, Bank Guarantee Fund, Integrated Solutions, Ministry of the Environment, Trusted Software Services, Union Parts, MBB Logistics, Univeg, Ministry of Justice, Ożóg i Tomczykowski, Mayland, Med4Med, EO Networks, Helping Hand, Fratria, Lobster, Credit Information Bureau, TLS – Boca Systems, Agency for Restructuring and Modernization of Agriculture, Grabowski i Wspólnicy, Merlin Group, Florexpol, Estelligence, Agersol, Netbulls, Baltrafood, Sygnity, AD Invest, Red Ocean, Fazbud Instal, Gas-Trading, Green Energy, Business Consulting Group, Institute of Environmental Protection, Siódemka, Kasa Stefczyka, District Court in Warsaw, Tech Soft, Tomax, National Center for Agricultural Support.

In addition, the Company has cooperated and continues to cooperate with entities from the medical and medical-related industries, including

the Medical University of Łódź, the Lublin Oncology Center, the Opole Oncology Center, TrichoLAB, the CODE Medical Center, Diagnostyka, Medidesk, the e-Health Center (in cooperation with Trusted Software Services), and Neuca.

Employment structure

As at March 31, 2024, the Issuer employed and cooperated with 47 persons, including 3 persons performing functions by virtue of appointment, 13 persons performing work under employment contracts, 30 persons providing services under B2B contracts, and one person providing services under a civil law contract.

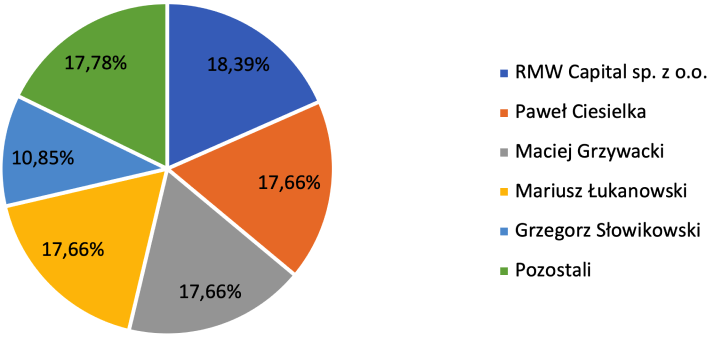

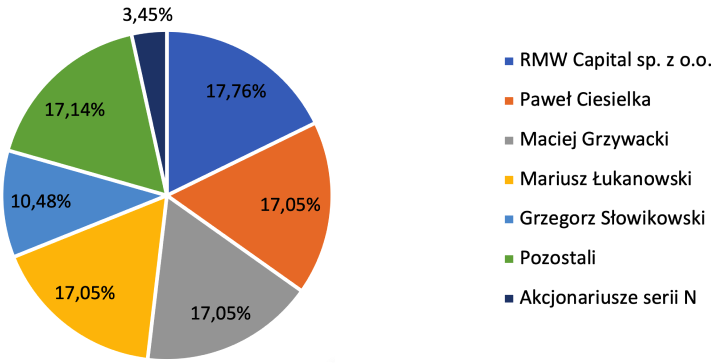

Shareholder structure

Shareholders – before and after the offering

Before the offer

After the offer

Development strategy

2Q 2024

Launch of the SmartLab module as part of the “I take care of myself” platform for consumers. Promotional campaign for the new solution.

3/4Q 2024

Introduction of the SmartLab module for businesses, i.e., medical institutions and companies. Promotional campaign for the new product. Completion of the first DBCU test projects.

1Q 2025

Launch of the Patient Portal in a white label format.

2Q 2025

Launch of the DCCU program focused on the treatment of colorectal cancer. Launch of the SmartLab service for primary health care (POZ).

4Q 2025

Introduction of the DLCU program focused on the treatment of lung cancer.

Public offering

The subject of the Public Offering are ordinary bearer shares of Proacta S.A. (“Company”) series N with a nominal value of PLN 0.50 each, in a total number of 2 to 4,049,139 shares, at an issue price of PLN 0.50. The offering is carried out with preemptive rights.

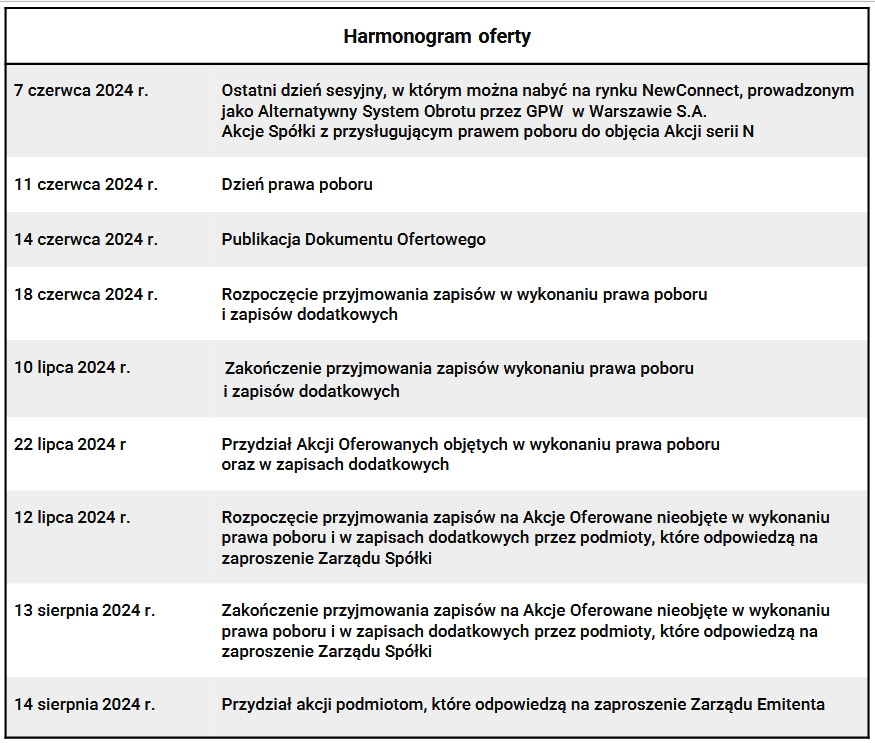

Offer schedule

Offer schedule

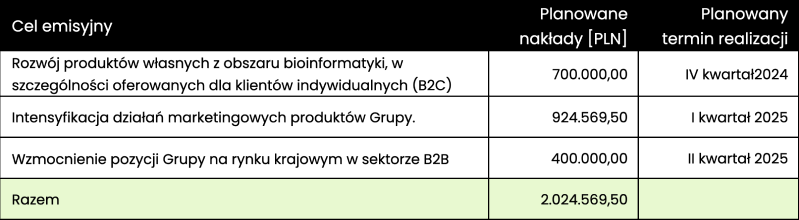

A detailed description of the issuance objectives is provided in the Offering Document dated June 14, 2024, in Chapter III, section 7.14.

The Issuer will issue between 2 (two) and 4,049,139 (four million forty-nine thousand one hundred thirty-nine) series N shares offered under preemptive rights at an issue price of PLN 0.50 (fifty groszy) plans to raise from PLN 1 (one zloty) to PLN 2,024,569.50 (two million twenty-four thousand five hundred sixty-nine zlotys and fifty pennies).

The issuance objectives listed above have been ranked according to the priorities assigned to them by the Issuer, which means that individual objectives will be achieved provided that the appropriate amount of financing is obtained from the issuance of series N shares.

The Issuer’s Management Board notes that the above-described issue objectives may be subject to change in terms of amounts and dates of implementation if the Issuer decides that the implementation of other objectives will contribute more effectively to the Company’s development.

If an objective is identified which, in the opinion of the Management Board, will better contribute to the Company’s growth, the Management Board may decide to allocate the funds raised to another objective. In such a situation, the Management Board will present an alternative objective that fits in with the assumed development strategy.

If the planned funds from the issue of series N shares in the amount of PLN 2,024,569.50 are not obtained, the Issuer intends to achieve the above-mentioned issue objectives from the proceeds of its current operations.

How to subscribe?

Management Board Tranche

To participate in the offer in the tranche of invitations issued by the Management Board, you must be a client of DM INC S.A. (hereinafter referred to as the “Brokerage House”) between July 23 and August 6, 2024. To do so, you must conclude an order acceptance and transmission agreement (hereinafter referred to as the “OAT Agreement”) with the Brokerage House and, within its scope, undergo an assessment of the suitability of the brokerage service in terms of acceptance and transmission, which will determine whether you are in the target group of recipients for the offered shares.

I. For future clients of the Brokerage House:

Step 1:

Write to Dom Maklerski INC S.A. using the form at the bottom of the page: https://dminc.pl/kontakt, entering Proacta in the subject line. A Brokerage House employee will contact you.

Step 2:

Complete the procedure to prepare for the conclusion of the PPZ Agreement. If the verification is positive, sign the agreement in accordance with the instructions provided by an employee of Dom Maklerski INC.

Step 3:

Fill out the Registration Form on this page and sign it with a qualified signature or ePUAP trusted profile and send it electronically to the following email address: [email protected] or sign the form in person and deliver it to the headquarters of Dom Maklerski (ul. Abpa A. Baraniaka 6 in Poznań) or the Customer Service Point (ul Wspólna 35 lok. 12, Warsaw).

Step 4:

Pay the full amount for the subscription to the bank account of Dom Maklerski INC S.A. indicated in the Subscription Form by August 6, 2024, inclusive.

Concluding a PPZ agreement with Dom Maklerski is free of charge. Dom Maklerski does not charge any commission on the transactions it mediates.

II. For current clients of the Brokerage House:

Step 1:

Write to Dom Maklerski INC S.A. using the form at the bottom of the page: https://dminc.pl/kontakt, entering Proacta in the subject line. A Brokerage House employee will contact you.

Step 2:

Fill in the Registration Form on this page and sign it with a qualified signature or a trusted ePUAP profile and send it electronically to the following email address: [email protected] or sign the form in person and deliver it to the headquarters of Dom Maklerski INC S.A. (ul. Abpa A. Baraniaka 6 in Poznań) or the Customer Service Point (ul Wspólna 35 lok. 12, Warsaw).

Step 3:

Pay the full amount for the subscription to the bank account of Dom Maklerski INC S.A. indicated in the Subscription Form by August 6, 2024, inclusive.

The correctness of the subscription is determined by the payment for the shares being credited to the Brokerage House’s bank account by August 6, 2024. If the payment is not credited, the subscription will be invalid.

Subscriptions for the remaining Series N Shares not covered by the preemptive right and after taking into account additional subscriptions submitted by investors selected by the Management Board will be accepted between July 23, 2024, and August 6, 2024.

Pursuant to Article 436 § of the Commercial Companies Code, Series N Shares will be allocated by the Issuer’s Management Board at its discretion, but at a price not lower than their issue price.

Subscriptions for the remaining Series N Shares submitted by investors selected by the Management Board will be accepted by Dom Maklerski INC S.A. (the Intermediary) in a manner agreed with the Intermediary.

Detailed distribution rules are described in Chapter III, point 7 of the Offering Document dated June 14, 2024.

Preemptive Rights and Additional Subscription Tranche – completed on July 10, 2024.

Step 1:

A shareholder holding shares in the Company at the end of June 11, 2024, is entitled to exercise the Preemptive Right.

Step 2:

After logging into your brokerage account, you should see a tab labeled “Issue with Preemptive Rights,” “Public Offerings,” or similar.

Step 3:

After entering the appropriate tab, you must submit your subscription in accordance with the procedure applicable to each brokerage house.

Subscriptions for Series N Shares based on Preemptive Rights must be submitted during the Subscription Period at branches (customer service points) of:

§ the brokerage house (office) maintaining the securities account on which the Preemptive Rights are registered,

§ the brokerage house (office) indicated by the bank maintaining the securities account on which the Preemptive Rights are registered.

Subscriptions for Series N Shares under preemptive rights and additional subscriptions will commence on June 18, 2024, and will be accepted until July 10, 2024.

Detailed distribution rules are described in Chapter III, point 7 of the Offering Document dated June 14, 2024.

Subscriptions based on Preemptive Rights and Additional Subscriptions may be submitted during the business hours of the institutions accepting subscriptions and paid for in accordance with the rules of operation of those institutions. Subscribers must take into account additional restrictions imposed by institutions accepting subscriptions for Series N Shares, such as accepting subscriptions within a limited time, in specific locations, or the need to pay additional fees.

For this reason, the Issuer advises all persons entitled to submit Subscriptions for Series N Shares to familiarize themselves in advance with the terms and conditions for accepting subscriptions by brokerage houses maintaining their securities accounts or brokerage houses indicated by banks maintaining their securities accounts.

If not all Series N Shares are taken up under the preemptive right and after taking into account additional subscriptions, any subscriptions for the remaining Series N Shares submitted by investors selected by the Management Board will be accepted from July 23, 2024, to August 6, 2024. Pursuant to Article 436 § 1-3 of the Commercial Companies Code, Series N Shares will be allocated by the Issuer’s Management Board at its discretion, but at a price not lower than their issue price.

If, in the exercise of preemptive rights and after taking into account additional subscriptions, not all Series N Shares are subscribed for, any subscriptions for the remaining Series N Shares submitted by investors selected by the Management Board will be accepted by Dom Maklerski INC S.A. (the Intermediary) in a manner agreed with the Intermediary.

DISCLAIMER

The public offering of Proacta S.A. Shares is conducted:

on the basis of the Offering Document available at the link below,

exclusively within the territory of the Republic of Poland.

Outside the territory of the Republic of Poland, the Offering Document may not be treated as a proposal to purchase or an offer to sell Shares, or as an intention to solicit offers to purchase Shares in any other jurisdiction where such actions would be contrary to applicable regulations.

The information and documents posted on this website are not intended for publication or distribution outside the territory of the Republic of Poland. The Offering Document and the shares covered by it have not been registered, approved or notified in any country other than the Republic of Poland, in particular in the United States of America.

By using any of the links below, you confirm that you:

are not located in the United States of America or in any other country whose laws prohibit the viewing of such materials,

are not a resident of the United States (U.S. Person) within the meaning of Regulation S, which is an executive act to the U.S. Securities Act of 1933, as amended, and does not represent or act on behalf of such a person,

has read and understood the above disclaimers.

If you have any questions, please contact us using the form available at www.dminc.pl/kontakt, entering “Proacta S.A. Offer” in the subject line.

Before accessing the information on this website, please carefully read the following terms and conditions of access to this website and the important information contained therein. By selecting the “Accept and continue” option below, you confirm that you have read the important information below, agree to the restrictions contained therein, and undertake to comply with these restrictions. Please note that the important information presented below is subject to change or update. Therefore, you should read and review it in its entirety each time you visit this website.

The materials and information to which you will have access relate to or are connected with the public offering of 2 to 4,049,139 series N ordinary bearer shares of Proacta S.A. with its registered office in Warsaw (the “Company,” “Issuer”) conducted in the territory of the Republic of Poland (“Public Offering”). The terms and conditions of the Public Offering are set out in the Offering Document relating to the Public Offering (“Offering Document”) published on the Company’s website (https://proacta.pl/ ofertapubliczna/) and on the website of Dom Maklerski INC S.A., the broker acting as an intermediary in the Public Offering (http://dminc.pl/oferta-publiczna/proacta).

The Company is responsible for the accuracy, reliability, and completeness of all information contained in the Offering Document. Subject to the provisions of law, the entity acting as an intermediary in the Public Offering, i.e. Dom Maklerski INC S.A., or any entity affiliated with DM INC, is not responsible for the accuracy, reliability, and completeness of the information disclosed in the Offering Document, supplements, and updates thereto, except for the information indicated in the DM INC statement contained in Chapter II of the Offering Document. The Offering Document is the only legally binding document containing, for the purposes of the Public Offering, information about the Company, the Company’s shares offered and the Public Offering. The Offering Document has not been approved or reviewed by the Polish Financial Supervision Authority. Before making an investment decision regarding the subscription of the Company’s shares in the Public Offering, you should read the Offering Document and any supplements and updates thereto.

Investing in shares involves a number of investment risks, and therefore investors should carefully and thoroughly review the entire Offering Document, in particular the risks associated with investing in the Company’s shares described therein. The materials posted on this website include the Offering Document, any supplements and updates thereto, and information that is promotional (advertising) in nature and is used for the purposes of the Public Offering or constitutes information disclosed by the entity conducting the Public Offering to the public as part of that entity’s obligations.

These materials and information do not constitute an offer to sell securities in the United States of America, Canada, Japan, Australia or any other jurisdiction where it would constitute a violation of applicable law or require registration, notification or approval. Securities may not be offered or sold in the United States unless they have been registered with the United States Securities and Exchange Commission or are exempt from registration under the relevant provisions of the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act of 1933”). The Company’s securities have not been and will not be registered under the U.S. Securities Act and may not be offered or sold in the United States unless exempt from registration or in a transaction not subject to the registration requirements of the U.S. Securities Act. Neither the Offering Document nor the Company’s shares covered by the Public Offering have been or will be registered, approved or notified in any country outside the Republic of Poland, in particular in accordance with the provisions of Regulation (EU) 2017/1129 of the European Parliament and of the Council (EU) 2017/1129 of the European Parliament and of the Council of June 14, 2017, on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market, and repealing Directive 2003/71/EC, and may not be offered or sold outside the Republic of Poland (including in other European Union countries, the United States of America, Canada, Japan, and Australia), unless such an offer or sale could be made in a given country in accordance with the law, without the need for the entity conducting the Public Offering and its advisors to meet any additional legal requirements in connection with the Public Offering. Any investor residing or having its registered office outside the Republic of Poland should familiarize themselves with the relevant provisions of Polish law and the regulations of other countries that may apply to them in connection with their participation in the Public Offering. The Public Offering is not directed at Russian or Belarusian citizens or natural persons residing in Russia or Belarus, or at any legal persons or other organizational units with their registered office in Russia or Belarus, or at other entities subject to restrictions on offering under national and EU regulations.